April 21, 2025

Why Solving Candidate Fraud Might Break Your Talent Acquisition Team

Whether you’re dealing with rampant credential fabrication or just the occasional assessment cheater, candidate fraud damages your recruiting process. Fraud extends time-to-fill, inflates costs through mishires, and dilutes the quality of your talent pool. To combat this challenge, organizations are implementing increasingly stringent countermeasures. Some have adopted comprehensive AI-powered screening or live proctoring tools, while others have gone as far as mandating in-person interviews.

But there’s a paradox. These increasingly severe countermeasures risk undermining the very metrics Talent Acquisition (TA) teams are held accountable for, as the most aggressive tactics come with costs: slower processes, higher spending, and worse candidate experience.

Fraud is worth addressing. But solving it completely may not be a panacea. The key is calibrating your response to the scope of fraud you face, commensurate with the risk it poses, not overcorrecting at the expense of everything else.

Why Solving Fraud Could Backfire

The instinct to root out candidate fraud is strong, especially when TA leaders are under increasing pressure from hiring managers, compliance teams, or executive leadership. But the paradox of solving fraud is that more aggressive mitigation strategies create more friction than they solve.

Flying candidates in for in-person interviews, for example, can give a clearer read on a candidate’s communication style, professionalism, and overall presence – but at a steep cost, as shifting from virtual to in-person interviews can add up to two weeks to the hiring process.

Assessments come with similar tradeoffs. A TA leader at a large semiconductor manufacturer recently shared that their team used assessments to filter talent at the top of the funnel, but each review added 15-20 minutes per candidate. Given their application volume, this additional review consumed thousands of recruiter hours and did not result in higher-quality talent.

This experience isn’t unique. A large, regional bank found their assessment tools were screening out too many qualified candidates, forcing them to abandon the practice entirely. Similarly, a major tech company discontinued their pre-recorded interviews after receiving overwhelming negative candidate feedback, showing how even well-intentioned mitigation tactics can cost you top talent.

Calibrating Your Response to Fraud

If solving fraud is a futile mission, one with real costs to efficiency, experience, and outcomes, then the challenge becomes managing it without compromising core recruiting metrics. This requires an approach that matches your fraud prevention tactics to your specific risk profile. Consider the following three-step approach.

Step 1: Assess Your Fraud Risk

First, categorize your hiring roles based on two key dimensions: volume (how many people you hire for this role) and criticality (how much damage a bad hire could cause). Once you’ve categorized your roles, evaluate them across three dimensions:

- Fraud Exposure: What types of fraud are you trying to prevent? Identity fraud? AI-assisted cheating? Resume embellishment?

- Process Vulnerabilities: Which hiring stages are most susceptible to fraud? Are there specific assessments or checkpoints where fraud would be particularly damaging to the hiring process?

- Resource Constraints: What is your realistic budget (time and money) for fraud prevention?

Step 2: Deploy Targeted Interventions

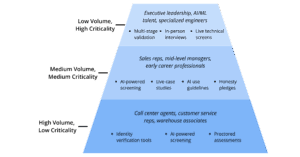

Once you’ve assessed your fraud risk profile, you can effectively map prevention strategies to role categories. Consider this framework for tailoring your approach based on three types of roles:

High-Volume, Lower-Criticality Roles

(e.g., call center agents, customer service representatives, warehouse associates)

In these roles, the challenge is less about risk and more about scale. And when you’re hiring hundreds or thousands of these candidates per year, manual screening simply isn’t feasible. This is where AI-powered screening and verification tools (e.g., HireVue, Filtered.AI, Talview) add the most value. These tools can surface the most promising candidates, flag inconsistencies, and even run assessments – all without burying recruiters in manual reviews.

Because turnover in these roles tends to be high, and the stakes of any one hire are relatively low, the emphasis should be on catching as much fraud as possible, even if that adds some friction into the candidate journey. That means leaning into systems that optimize for speed, scalability, and fraud filtering at the top of the funnel. While candidate experience matters, efficiency is undoubtedly the higher priority.

Many TA teams face resistance from legal and compliance teams when implementing these tools. However, we’ve seen that framing them as prioritization mechanisms, rather than screen-out or decision-making tools, consistently leads to more successful approvals.

Low-Volume, High-Criticality Roles

(e.g., executive leadership, AI/ML talent, specialized engineers)

At the other end of the spectrum are roles where the consequences of a fraudulent hire are severe: compliance violations, reputational harms, and hundreds of thousands of dollars in mishire costs. These cases call for a slower, more deliberate approach. And while it may inflate time-to-fill or cost-per-hire in the short term, the deeper validation is well worth the investment.

Multi-stage validation is especially effective here. This means testing the same core skills across multiple formats and phases of the hiring process. One top consulting firm, for example, uses an AI-based case study early in their process, followed by a live case study later to revalidate performance. This approach helps confirm that candidates can actually perform the skills needed for the role, particularly under different conditions.

In-person interviews and technical screens are also making a comeback in this tier. Anthropic, for instance, has shifted from remote to on-site interviews for technical roles – a tradeoff they believe is worth it to safeguard the integrity of their hiring.

For our members – access tips to win AI talent.

Medium-Volume, Medium-Criticality Roles

(e.g., sales reps, early career professionals, mid-level managers)

These roles often sit at the heart of your talent pipeline — not high-risk enough to justify intensive interventions across the board, but too important to ignore. A hybrid strategy works best here.

Automated tools can handle early-stage screening, but they should be paired with light-touch human involvement, like brief recruiter reviews, second-look assessments, or live follow-ups, to validate skills and surface red flags.

Talent at this level is typically invested in building their careers and cares about how they’re perceived, as well as the experience they’re receiving, so adopting a more human tone and communicating clearly about expectations can meaningfully shape their behavior.

One mid-sized accounting firm, for example, includes this message before candidates can submit an application: “Our Recruiting Team manually reviews every application, therefore, we ask that you ONLY apply to ONE position and confirm it aligns to your location and field of interest preference.” While not enforceable, statements like this send a signal that real people are paying attention, and that can shift how candidates engage.

Explicitly stating what is and isn’t permitted (as PwC, Canva, and Greenhouse do), being transparent about how candidates will be evaluated, and having candidates sign honesty pledges can also serve as lightweight deterrents.

Step 3: Measure ROI

Of course, these fraud mitigation efforts come with tradeoffs. They may lengthen hiring cycles, inflate costs, or introduce friction into the candidate experience. That’s where it becomes critical not only to find the right intervention, but to demonstrate that it’s worth the investment. Consider the following methodology as a starting place:

1. Calculate the Cost of Fraud

Estimate the potential loss from fraudulent hires using inputs like:

- Number of Fraudulent Candidates Flagged: Use real or estimated counts based on your screening.

- Estimated Cost of a Bad Hire: Often ~30% of annual salary. Factor in ramp-up salary, onboarding, and downstream impact.

- Total Time Wasted: Multiply hours typically spent on each fraudulent candidate (e.g., 3 hours) by the hourly cost of recruiters/interviewers.

- Team Disruption & Delay: Translate the extra time managers spend fixing downstream effects into cost (e.g., lost days × daily vacancy cost).

2. Calculate the Cost of Prevention

Capture every element contributing to the cost of your fraud strategy, including:

- Fraud Prevention Tool Costs: Total cost of software licenses, platform usage, and integrations.

- Manual Review Time: Multiply per-candidate review time (e.g., 15 minutes) by the number of candidates reviewed and recruiter hourly rates.

- Extended Time-to-Fill: For delays that impact start dates, calculate: Additional Days Delayed × Daily Cost of Vacancy

- Volume Sensitivity: Consider the number of candidates requiring review—this scales everything.

3. Assess ROI

Subtract prevention costs from avoided fraud costs. Then calculate:

- Net Savings = (Fraud Averted Savings + Time Savings) − (Fraud Prevention Cost + Time Burden Cost)

- ROI Ratio = Net Savings ÷ Fraud Prevention Cost

- Payback Period = Fraud Prevention Cost ÷ Monthly Net Savings

When prevention efforts move your metrics in the wrong direction, ROI becomes your defense. Use it to tell the story behind the numbers. “Yes, our time-to-fill went up three days – but it’s helping us avoid six-figure hiring mistakes.” Framing prevention as insurance, not just process optimization, will help your stakeholders see the value of these tactics.

The Bottom Line

Unfortunately, candidate fraud isn’t going away. In fact, with hiring rates slowing, fewer people resigning or being laid off, and more competition for open roles, misrepresentation may only grow.

But over-indexing on fraud prevention will compromise your core metrics: time-to-fill, cost-per-hire, and candidate experience.

Ultimately, the goal shouldn’t be a perfect hiring process – it’s a practical one that matches specific fraud prevention interventions to the exact types of fraud you’re facing, all within the context of your business and budget.