January 14, 2026

The Future of Early Careers

If you read the headlines, Early Careers as an industry is in trouble. Companies are cutting entry-level jobs, the job market for college graduates is terrible, and AI is sounding the death knell for junior work at companies writ large.

These aren’t just abstract provocations. They’re the questions CEOs and CHROs are posing and UR budgets are increasingly contingent upon.

Over the course of six months, we conducted an in-depth investigation of over 250 Early Careers programs. We looked across industries, across job roles, across companies of different sizes, looking for how the headlines are playing out on the ground for the largest organizations in the country.

What we found surprised us. It wasn’t a single main trend. What we found was divergence.

Some programs are expanding. Others are contracting. Many are holding steady. And programs are sometimes moving in opposite directions despite being in the same industries, facing the same macro conditions, or navigating the same external pressures.

That fracturing became the focus of our headline research initiative, and we set out to answer three existential questions for the future of Early Careers and what comes next:

- Is AI the end for Early Careers Recruiting?

- Why are some programs thriving right now while others are contracting?

- What is different about those that feel safe versus those on shaky footing?

→ If you missed our talk on The Future of Early Careers at our Annual Members Meeting, we have a member-exclusive catch-up session coming up.

The Existential Question — Is AI Killing Early Careers?

Before we could investigate the future of the field, we had to confront a fundamental question: Does Early Careers have a future, or is AI supplanting it?

Dario Amodei, CEO of Anthropic, says AI could eliminate half of all entry-level white-collar jobs within five years. The Wall Street Journal declared 2026 the worst job market for college grads since the pandemic. More than half of employers rate the job market for the Class of 2026 as “poor” or “fair;” the most pessimistic outlook since 2020. Recent grad unemployment hit nearly 6% in Q1 of 2025, the highest since July 2021. And for the first time in decades, recent grads have a higher unemployment rate than the overall workforce.

On the surface, it’s easy to connect those dots: AI is automating and wiping out entry-level work.

That’s a serious claim, but is it true or hype?

We split that question into two parts:

- Is AI responsible for the difficult market we’re in today?

- Will AI reshape Early Careers in the future?

Part I: Is AI responsible for today’s Early Careers challenges?

We tested this hypothesis across three dimensions. If AI is the primary driver of the difficult conditions we see for early career hires, we should expect to see three things.

- Recent graduate unemployment should track with the release of AI tools

- AI-exposed majors should fare worse than their less AI-exposed peers

- Job losses should be more concentrated in AI-exposed occupations

Essentially, if AI is the main story, then we’d expect the launch of AI tools to kick off worsening outcomes for early career talent, and for the roles and majors most easily replaced by AI to have worse employment outcomes than work that can’t be automated.

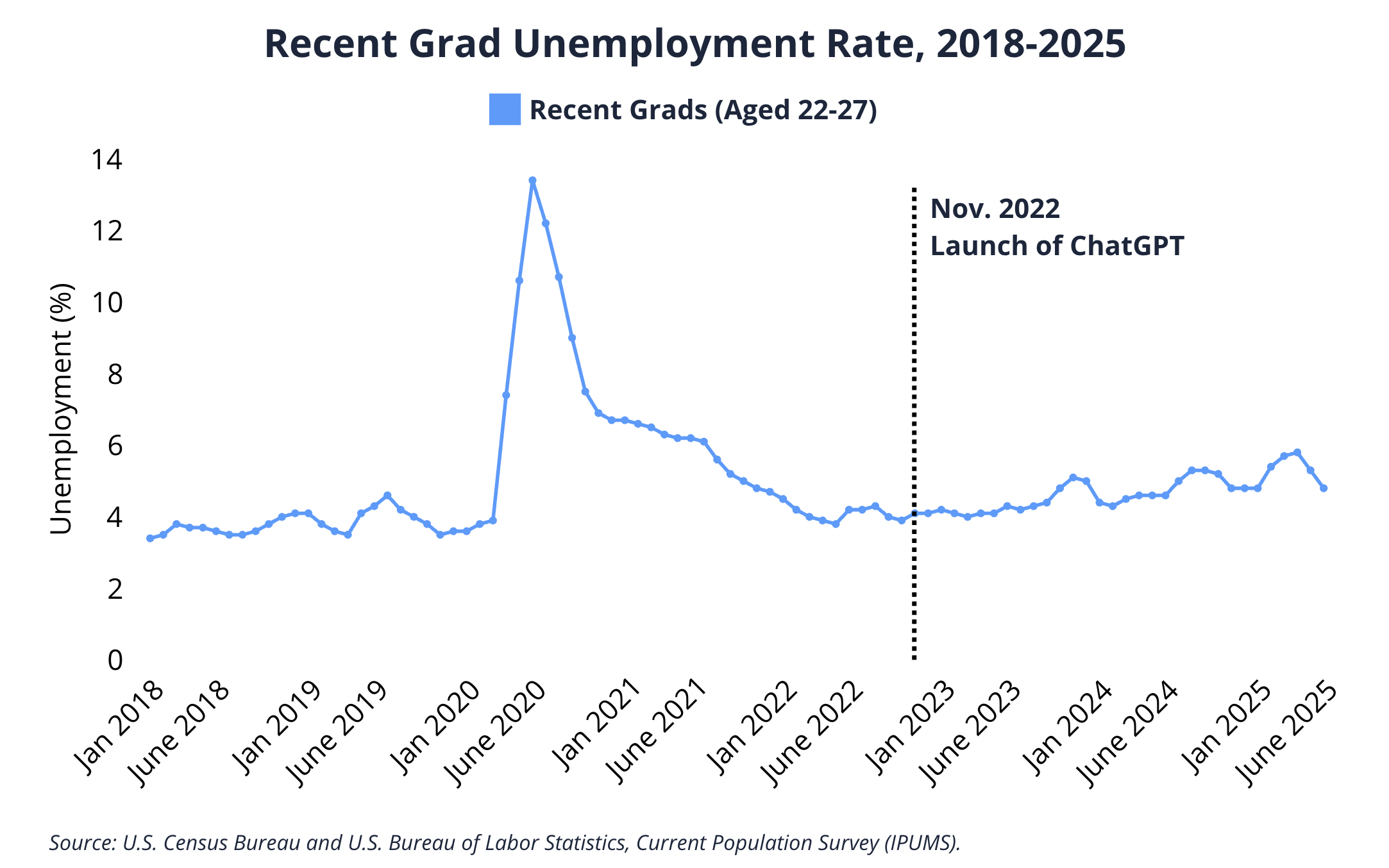

Test 1: Does recent grad unemployment follow the launch of GenAI tools?

It doesn’t.

Recent grad unemployment started accelerating in 2018; four years before the public release of the first major AI model (ChatGPT) and long before AI tools reached widespread adoption. When ChatGPT was released in November 2022, the recent grad unemployment rate was 4.1%. By mid-2025, it had risen slightly, to 4.8%. This isn’t the trajectory of a market undergoing sudden technological disruption.

Test 2: Do AI-exposed majors show higher unemployment than their peers?

They don’t.

We analyzed a set of majors with high AI exposure — those where graduates typically pursue roles involving tasks that AI can assist with: data analysis, coding, design, etc. The results were incredibly mixed and missing a clear AI thread. In some cases AI exposed majors do look worse off. Unemployment for computer science majors is up nearly 1%. But there’s virtually no change for finance majors (+0.2% unemployment) and other AI-related majors are seeing a boon in employment. Accounting (-0.5%); electrical engineering (-1.1%), or Math (-1.2%) are facing better job prospects post-AI than pre-AI.

Test 3: Are employment declines widespread across all AI-exposed occupations?

No, but with an interesting caveat.

Employment declines are concentrated in roles where AI automates entire workflows. Think chatbots handling customer inquiries, or Copilot generating code and documentation.

But in occupations where AI augments human work, making people faster or more accurate in their work, early career employment is stable or even growing (e.g., healthcare aides using AI for documentation; financial analysts using it for research). It’s not just about whether a role is exposed to AI. It’s about whether AI is being deployed to replace or amplify human capability. And that distinction matters.

→ Our Conclusion: Today’s tough market doesn’t look like an AI-driven collapse, but AI may be complicating a recession-style economic correction.

So what is? We see three converging forces:

- Post-pandemic overcorrection: Companies over-hired in 2021-2022, with the tech sector alone adding 372,000 jobs between 2020 and 2022, and then announcing 580,000 layoffs from 2022-2024.

- Efficiency gains without headcount growth: Corporate revenue is rising, but hiring isn’t—especially in white-collar sectors.

- Macro conditions that mirror 2008: Unemployment among recent grads has climbed to its highest non-pandemic level in over a decade. A tough macro environment hits new grads first and hardest, not because they’re less valuable, but because their roles are the easiest to freeze without triggering layoff headlines or retention crises.

And yet… expansion still exists.

Over a third of companies in our membership are increasing intern and full-time hiring in 2025-2026. Only 8% are cutting by more than 10%.

And perhaps most strikingly: not a single company we interviewed has eliminated a category of Early Career jobs due to AI*.

*As of December 2025

Which brings us to the second question:

Part 2: Will AI reshape Early Careers in the future?

Here, the answer is more complex.

Some early career roles will almost certainly be displaced. Productivity gains may lead to smaller intern classes. Skills in demand may change. In short, change is coming, and it’s likely to force an evolution in the value proposition of Early Careers to the organization.

The Changing Value Proposition of Early Careers

When we mapped out the state of Early Careers programs, we saw three segments emerge:

- 59% of programs are in stasis

- 22% are expanding with new investments in EC

- 19% are contracting with programs being scaled back or completely eliminated

This divergence isn’t explained by industry, or company size, or revenue. Within nearly every grouping we found companies expanding alongside those holding steady or contracting.

So we turned to reasons leaders cited for their program shifts.

Drivers of expansion:

- Business strategy shifts (41%)

- Competition for talent (27%)

- Leadership priority shifts (16%)

- AI & automation (10%)

Drivers of contraction:

- Budget & economic pressure (46%)

- Business strategy shifts (25%)

- Leadership priority shifts (22%)

- DEI policy changes (3%)

Many of the same drivers appeared for both programs in expansion and contraction. To understand which programs were thriving, we had to understand how they were positioning their value.

This lens revealed that two-thirds of companies changed how they frame their value to the organization in the past year. Diving deeper, we found three value props that are eroding in their power within businesses and four that are rising in resonance. Though not an absolute observation, programs that organize their value props around the former are contracting more than those who organize their value props around the latter category.

Eroding Value Propositions

DEI as a primary justification

This was the most common foundation being walked away from. Historically, DEI was a key pillar for Early Careers as campus programs were central to how companies accessed diverse talent. But then, almost overnight, the ground shifted. Federal executive orders revoked long-standing DEI obligations for federal contractors and ordered agencies to shut down DEI offices. Laws like Texas Senate Bill 17 restricted DEI practices at public universities. And the impact? Programs that leaned heavily on DEI as a singular justification were often scaled back. More than half of contracting programs that changed their value prop had leaned on DEI as the central value pillar. The programs that have survived this shift were the ones that had already built a case around other sources of value: cost, leadership pipelines, agile talent.

Cost-effective talent (without proof)

One of the core justifications of Early Career programs is cost; that teams can hire for entry-level roles more affordably than experienced, lateral hires. But now budgets and productivity are under intense scrutiny, and the “cost-effective hiring” argument is being challenged, and in many cases, it’s not holding up.

Beyond cost-per-hire, leaders are pushing on conversion rates, time to productivity, and retention. At the same time, the costs of campus travel, events, recruiter time, onboarding, and training are being examined more closely. With increased scrutiny on both performance and spend, the ROI of Early Career programs has become much harder to prove.

Programs without strong data on conversion, retention, or productivity are losing credibility. In one example, a biopharma company saw its program cut after realizing it was converting only a fraction of interns and had no clear ROI story.

Campus presence as inherent value

We used to hear: “We go to this school because we’ve always gone to this school.” Now we hear: “What’s the yield? What’s the cost per hire?”

From 2022 to 2025, the share of companies narrowing their campus approach to a core or target school strategy rose by 53%. The era of “go everywhere” is ending. Companies are narrowing their focus.

One financial services firm that used to treat campus presence as part of its brand strategy now treats it as a cost center. They’ve built tracking tools to tie events to outcomes—not just hires, but interview conversion rates, quality of talent coming through each channel, and whether those hires are actually converting to full-time roles and staying.

That’s the shift. Programs holding onto old-school presence-based justifications are falling behind. But the ones that are thriving are the ones who can draw a straight line from presence to results. They’re selecting schools based on yield, conversion, and strategic alignment.

Emerging Value Propositions

Even as some existing value propositions are eroding, new ones are emerging or evolving. And here’s what connects them: they’re all framed around what Early Careers solves for the business, not just what Early Careers does.

- AI & specialized skills acquisition

94% of programs citing AI-readiness as a value proposition are expanding. AI hiring is up across sectors: tech, healthcare, energy, telecom. Early Careers is one of the main ways companies are accessing cost effective AI-fluent and AI-native talent. - Talent agility & plasticity

One in four jobs has changed 75% of its required skills in three years, and one of the biggest questions from leaders is “what are the skills we’ll need in 5 years.” Early Career talent is adaptable. By virtue of being at the start of their careers these hires are moldable, and able to flex across future needs. - Bench-building for talent shortages

As 4.1M Americans retire annually some programs are building long-term pipelines now. Advanced manufacturing, accounting, and healthcare are leading this charge, as they expect major global worker shortages. - Proven leadership pipeline

Not an aspiration. A record. The strongest programs can point to alumni in VP roles, outperformance on retention and promotion, and systematic leadership development.

Navigating the Shift

Everything comes back to solving business problems. More specifically, the expanding programs more consistently position themselves to uniquely and credibly solve hard business problems. While that seems extraordinarily simple, the one strong, consistent theme across 250 Early Career programs, wasn’t the economy, or industry, or program quality or size, it was that the programs that are expanding found key business problems and have proven that they provide a unique solution to that problem.

With the programs that are contracting, we found one of two things to be true.

- The problems they’re focused on are ones the business isn’t that focused on anymore

- They’re focused on the right problems but they have no concrete, tangible proof that they are the right solution for it

So what do you do with all of this?

How do you evolve your program to withstand scrutiny and solve business problems?

We found three strategies among the most successful programs:

1. Proactive Evolution

These programs are reading signals early. They’re mapping where pipelines are thinning. They’re extending planning horizons. They’re piloting new models while the current ones still work.

Example: An oil and gas company expanded into apprenticeships and community colleges when they saw petroleum pipelines drying up. They acted before crisis.

Example: A healthcare firm needed 9,000 pharmacists over 10 years. They launched fellowships and doubled intern hiring today—to solve for 2035.

2. Strategic Acceleration

These programs are solving emerging business problems. They’re aligning to organizational needs.

Example: A financial services company used Early Careers to fix an upside-down org structure. Too many seniors, not enough juniors. Early Careers became a lever for efficiency.

They built a white paper: benchmarking competitors, showing internal performance data, and tying Early Careers to broader initiatives. Outcome? 2.5x internship growth in tech.

3. Building Defensibility

These programs are uncuttable. Because they’ve built the proof.

Example: A semiconductor firm hires two-thirds of its workforce through Early Careers. Every business unit is evaluated on Early Careers mix. Alumni are in leadership. The program is embedded.

This is defensibility. Data, structure, advocacy.

Where Do We Go From Here?

Here’s what we know:

- AI isn’t killing Early Careers today

- Programs are diverging based on value proposition

- The case is shifting from cost and presence to strategy and proof

Here’s what we don’t know:

- How will AI reshape entry-level work in the middle- and long-term

- Which programs in stasis will face scrutiny next

- What the next wave of disruption will look like

But we do know this:

Programs that solve hard business problems—and can prove it—are thriving.

That’s the work ahead.

So: What does your program solve? Can you prove it? Are you building the case today, before you have to defend it?