October 06, 2025

Navigating Visa Shifts: What Recruiting Leaders Need to Know This Fall

Disclaimer: At Veris Insights, we are committed to providing timely updates and resources on the evolving landscape impacting Talent Acquisition and Early Career teams. Due to the legal complexities of these developments, we strongly encourage teams to consult with their legal and compliance professionals.

The U.S. visa landscape is shifting rapidly, and for recruiting leaders, the implications are immediate. In recent weeks, we’ve seen a confluence of policy changes and proposals that could reshape Early Career hiring pipelines, especially in technical fields.

At Veris Insights, we’ve been listening closely to our members, analyzing data, and surfacing peer strategies. Here’s what you need to know now, and what you can do to stay ahead.

Visa Changes Raise Alarms on Early Career Hiring

Two major visa changes are prompting University Recruiting and Early Career teams to reconsider sponsorship strategies.

A presidential proclamation now requires employers to pay $100,000 for every new H-1B visa selected by the lottery. The next lottery will go live in 2026. This change dramatically increases the cost of hiring foreign workers. While renewals and existing H-1B holders are exempt, major sponsors such as Amazon, Microsoft, Google, and JPMorgan face sharply higher costs, with startups and smaller firms likely to be hit hardest.

A coalition of unions, higher education groups, religious organizations, and businesses has sued the Trump administration over the unprecedented $100,000 H-1B visa fee. The lawsuit, filed in the Northern District of California, argues that the fee is unlawful, arbitrary, and devastating to American competitiveness.

A DHS-proposed wage-based H-1B selection system would prioritize higher-paid roles. This proposal is currently in its comment period and could reshape which early-career candidates secure sponsorship opportunities in future cycles.

These two changes are driving the most immediate operational questions for recruiting leaders and set the stage for deeper shifts to come.

Four Big Shifts Reshaping the Visa Landscape

- Mandatory In-Person Visa Interviews

Applicants must now complete in-person interviews, with additional scrutiny applied to social media activity. This adds friction to the student visa process and has already contributed to declining international student enrollment. - Proposed H-1B Selection Shift to Wage-Based System

DHS has proposed moving H-1B selection to a wage-based lottery, advancing petitions tied to higher Department of Labor wage levels. If enacted, this would favor Level III and IV roles. - Proposed Four-Year Cap on F-1/J-1 Student Visas

The administration has floated a proposal to cap F-1 and J-1 visas at four years, which could significantly affect longer programs such as PhDs. - New $100,000 Employer Fee for H-1B Petitions

On September 19, 2025, the White House issued a proclamation requiring a one-time $100,000 fee for all new H-1B petitions filed after September 21, 2025. Current H-1B holders and transfers are exempt, but the implications for new hiring are substantial.

Who Is Most Impacted?

When we step back and look at exposure to these policy changes, it’s clear some sectors and employers carry a disproportionate share of the burden.

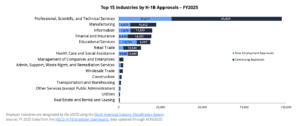

By Industry:

H-1B petitions are heavily concentrated in Professional, Scientific, and Technical Services, with nearly 100,000 approvals this year alone. Beyond that, Information, Finance & Insurance, and Educational Services also rely meaningfully on international hires.

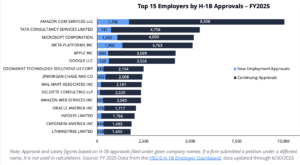

By Employer:

Large-scale tech and consulting firms dominate H-1B usage. Amazon and AWS together represent nearly 30% of top employer approvals, with Microsoft, Meta, Apple, Google, Deloitte, JPMorgan, Cognizant, Walmart, and Oracle also among the largest sponsors.

Startups and AI/ML Talent:

While large enterprises may absorb the new $100,000 H-1B fee, startups, especially those seeking AI and machine learning expertise, face existential challenges. Their margins often can’t sustain steep sponsorship costs, and talent alternatives are limited.

In short: the largest players can absorb costs, but mid-sized firms and startups are facing existential questions about talent strategy.

Specific Impact on Early Career Tech Pipelines:

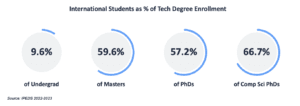

The proposed four-year cap on F-1/J-1 visas and ongoing declines in international student enrollment are particularly acute in technical disciplines. More than half of U.S. tech PhDs are held by international students, and nearly two-thirds of computer science PhDs are non-resident aliens. This means the very roles most in demand (advanced software engineering, data science, and AI/ML research) are the ones most likely to be disrupted by visa policy shifts.

For Veris Insights Members:

The SchoolScope tool in your Member Library can help you see where students in tech majors and disciplines are concentrated. These insights support smarter, more adaptable recruiting strategies as the visa landscape continues to change.

How Employers Are Responding

In our conversations with recruiting leaders, we’re seeing a range of immediate reactions to the visa changes. While strategies vary by company size and industry, a few patterns are emerging:

Business-as-Usual for Specialist Roles

Some employers continue to move forward with sponsorship for highly specialized, advanced-degree positions where international talent is viewed as irreplaceable. These tend to be lower-volume, high-skill hires where managers were already prepared to justify sponsorship.

Pausing or Reviewing Certain Return Offers

A subset of employers is pressing pause on return offers for international interns while they evaluate the financial and operational implications of the new $100,000 H-1B fee. Others are shifting focus toward candidates who already hold H-1B status, since transfers are not subject to the new surcharge.

Exploring Alternatives

We’re also hearing increased attention on alternative approaches. Some teams are assessing selective offshoring or distributed teams, while others are looking at near-shore hubs. Additionally, a number of employers are beginning to review their wage-band design, anticipating how the proposed wage-based selection system could reshape odds in future H-1B cycles.

What Recruiting Leaders Can Do This Month

While long-term strategies will depend on how policies evolve, there are a few practical steps recruiting leaders are focusing on right now:

- Take Stock of Candidates: Review your intern-to-full-time conversion pools and tag candidates by their work authorization: U.S. citizen/PR, OPT-eligible, or requiring sponsorship. This creates immediate clarity on where exposure lies.

- Understand Role Wage Levels: Map your key Early Career roles against Department of Labor wage levels. Knowing whether a role sits at Level I, II, III, or IV will help you anticipate how a wage-based H-1B lottery could play out.

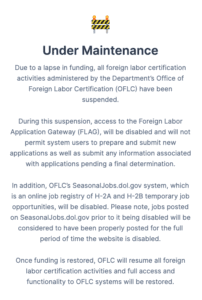

→ The OFLC Wage Search Tool is currently down as of October 6, 2025 due to the federal government shutdown.

- Model the Costs: Run quick scenarios: where would a modest compensation adjustment (0–5%) shift a role into a higher wage level? For critical positions, this could change H-1B selection odds in the future.

- Communicate with Candidates: Be proactive in explaining what has changed, what hasn’t, and when they can expect updates. Clear communication can ease rumor-driven anxiety among international students and Early Career hires.

- Sync with Legal and Mobility: Set regular checkpoints with legal, finance, and mobility teams. Document criteria for when to use the new H-1B fee, when to pursue transfers, and when to consider alternate work locations.

Bonus for Global Teams: Some organizations are pre-clearing one or two backup locations per role family. This contingency planning reduces last-minute scrambling if a petition doesn’t work out.

Looking Ahead

Visa policy will remain a moving target. While OPT and STEM OPT remain intact today, they are under scrutiny. And with DHS’s wage-based proposal still under public comment, more change is possible before the FY2027 cycle.

At Veris Insights, we’ll continue to track developments, translate policy into practical implications, and surface the strategies your peers are using. In moments like this, the role of recruiting leaders isn’t just to react; it’s to provide clarity, calm, and foresight to their organizations.

This is a challenging time, but it’s also an opportunity to sharpen talent strategy for resilience.

For Veris Insights Members:

Check out our Early Career Legal Tracker and join upcoming office hours with your service lead to workshop wage mapping and scenario planning.